Urban areas across the country have been dieting on land restrictions for the past decade. In 2016, a link was discovered between land use regulations and increases in housing costs. Many people may not be surprised by this. Rising housing costs and stagnant wages are forcing people out in the suburbs, pushing them farther into rural zones. Now more than ever is the best time to purchase land in these areas. Breaking new ground with us is an exciting endeavor, but we want you to be conscious of some things before you move ahead.

Check With Your Local Department of Natural Resources

A property with a wetland designation can fall under special protections. Developing on this designation can spell significant financial loss. Many city slickers make this mistake. In one case, a man setting himself up for retirement was forced to pay $72,750 in violation fees after developing on land he had purchased in Chesapeake, Virginia.

Wetland protections maintain their key ecological features. A wetland can help regulate pollutants and buffer flooding zones while providing habitats for many lifeforms. You won’t see these regulations disappear anytime soon, so it’s important you check for this designation before breaking ground.

Another question you can ask is if the property falls under an “open” land policy, rather than a closed one. Having an open policy means you could qualify for a tax break.

Township Ordinances

These vary depending on where you live. Local municipalities regulate burning permits, weapon restrictions, and other trivial rules we follow in our day-to-day lives. Cities are much more zealous with these low-level policies. Ensuring you don’t find yourself trapped in with small-town regulation might defeat the purpose of moving out to the country in the first place.

Checking County Property Records

Regardless of a town’s size, there’s always an archive somewhere deep in its records detailing a property’s history. Knowing how many times it was on the market can be a good indicator of a few things. Additionally, knowing how much was originally taken out, price drops, add-ons, etc. can really help leverage you into getting a good deal. The big thing you should be looking for is market retention. How many times has this land been on and off the market? If it’s often, then there is probably a red flag in there somewhere.

While you’re digging around, be on the lookout for easements or other conditions on your property. Older land claims can sometimes come with certain conditions, like land stakes taken out by companies or government agencies. Finding an easement on a property could mean there’s a shared portion. Typically, this isn’t something to really worry about. All this means is that your road might be used by the public to get somewhere else.

Who’s Living Nearby?

The last thing you want is to end up living next to a fracking site. You can find out who your neighbors are or will be, by looking them up in the county’s tax records. Once you find some names, plug them into a search engine; there’s no shame in wanting to know.

Factors that Affect Homeowners Insurance

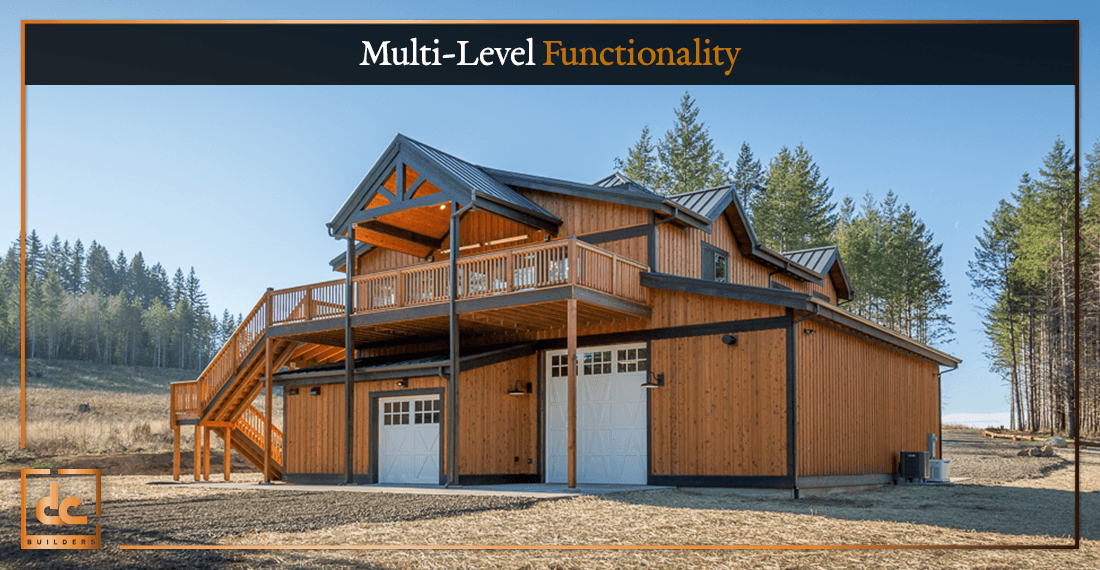

Homeowners insurance is a necessity for anyone taking on a post and beam structure with us. Prices for insurance rates fluctuate depending on various factors.

Heating options such as the number of fireplaces, whether or not if your using gas versus electricity.

Your proximity to emergency services can actually make a huge difference in price. Living next to a fire station specifically, has the advantage of possibly saving you thousands. A class 10 property paying $2,000 a year can be reduced to a class 5, which warrants a 50% discount.

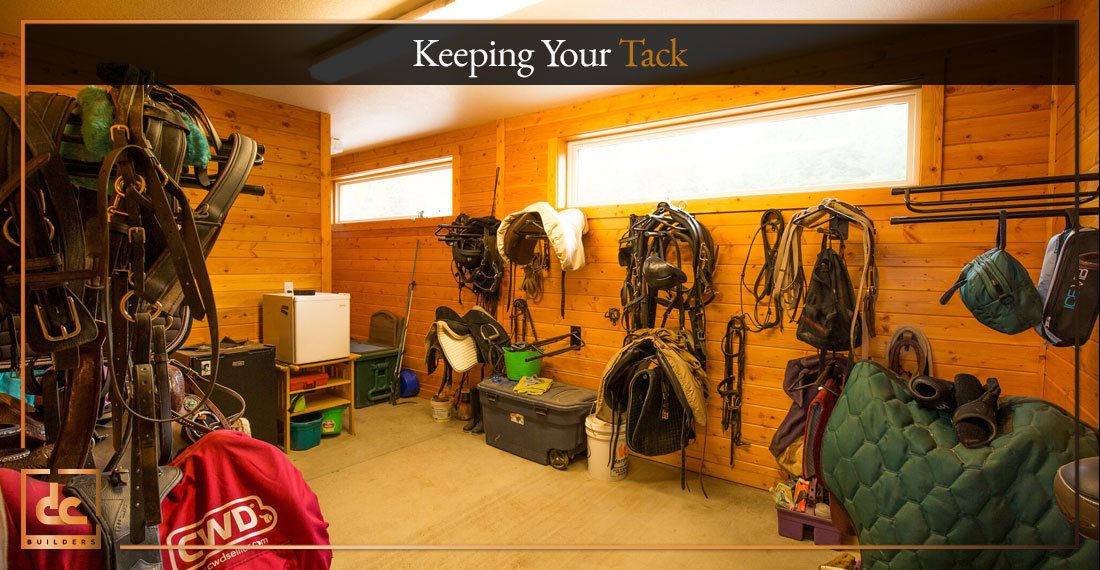

Owning livestock is another random variable that unfortunately effects the price of homeowners insurance. Like fireplaces, the price mainly depends on the type and amount of livestock on your property.

Finding out which real estate tier you fall into can also be a helpful thing to know. The main differences between tiers are largely classified by the level of development taking place in a particular area. For example, a tier I status means your property is in a highly developed area, surrounded by plenty of services such as schools and hospitals. A tier III would be the opposite, the kind of designation used to describe underdeveloped rural areas. Call your insurance agent or local real estate broker to see which tier you fall under.